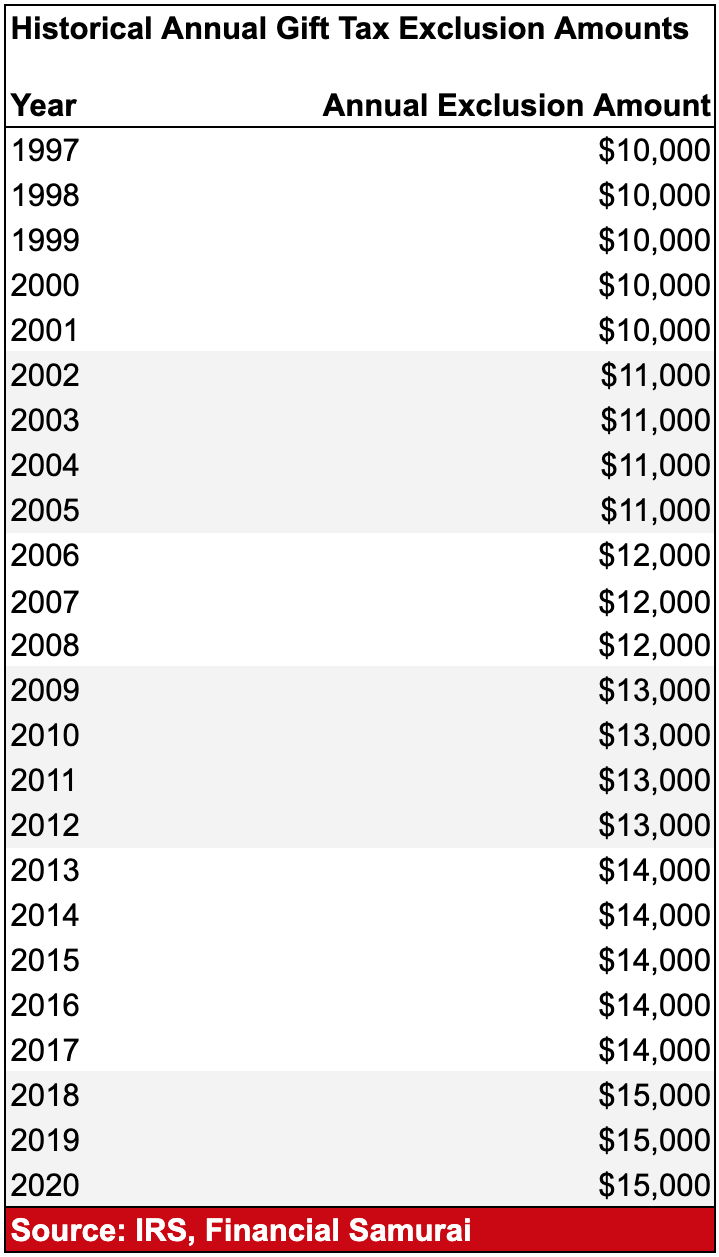

Annual Gift Tax Exclusion 2025 Chart Printable - Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2025, in tandem with the significant adjustments in the. Las Vegas Residency 2025 Shows. Las vegas residency artists come from various musical genres and […]

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2025, in tandem with the significant adjustments in the.

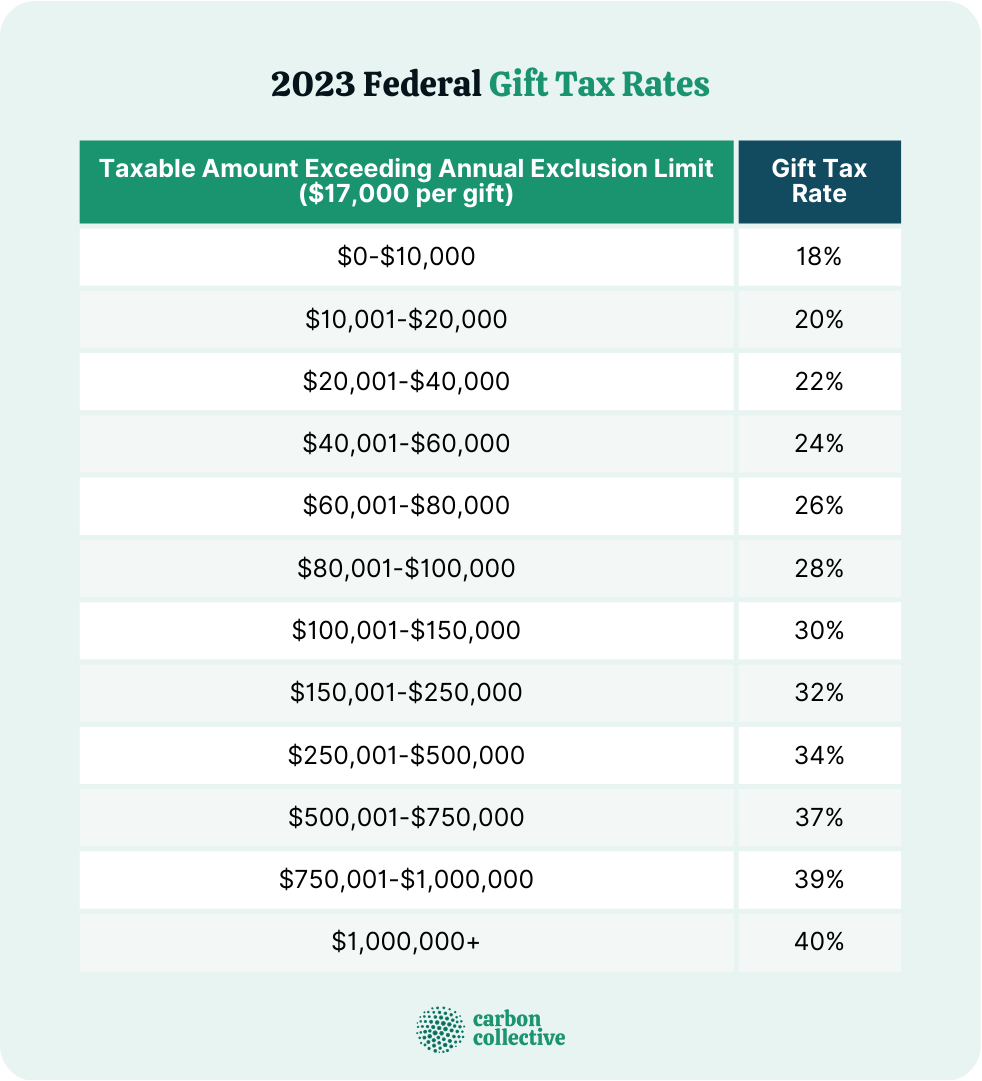

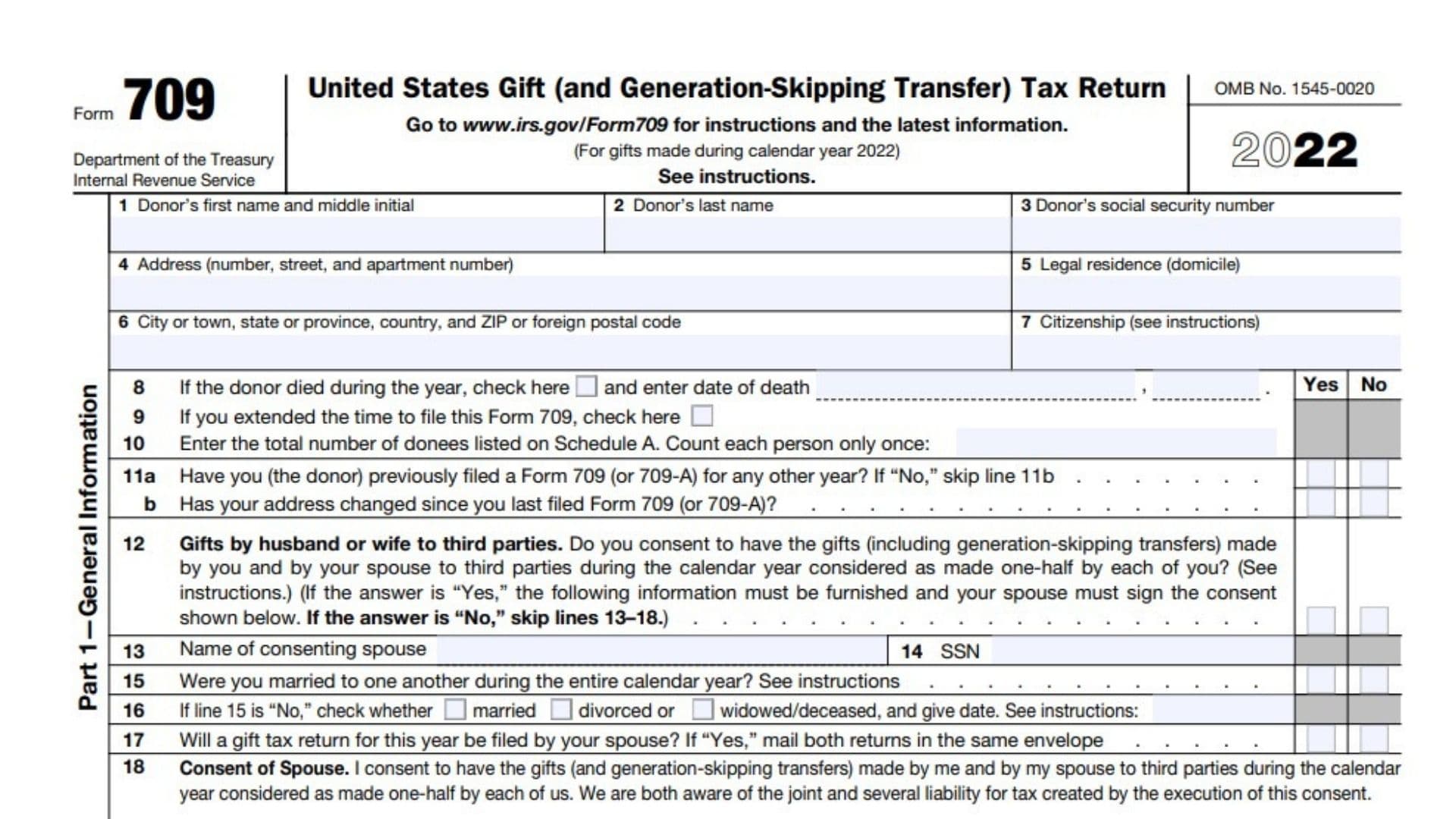

Annual Gift Tax Exclusion, Annual federal gift tax exclusion. The irs has announced an update to the annual gift tax exclusion, raising the limit from $17,000 in 2023 to $18,000 for 2025.

2025 Annual Gift and Estate Tax Exemption Adjustments Rose Elder Law, This change presents a valuable. In 2023, the annual gift tax limit was $17,000.

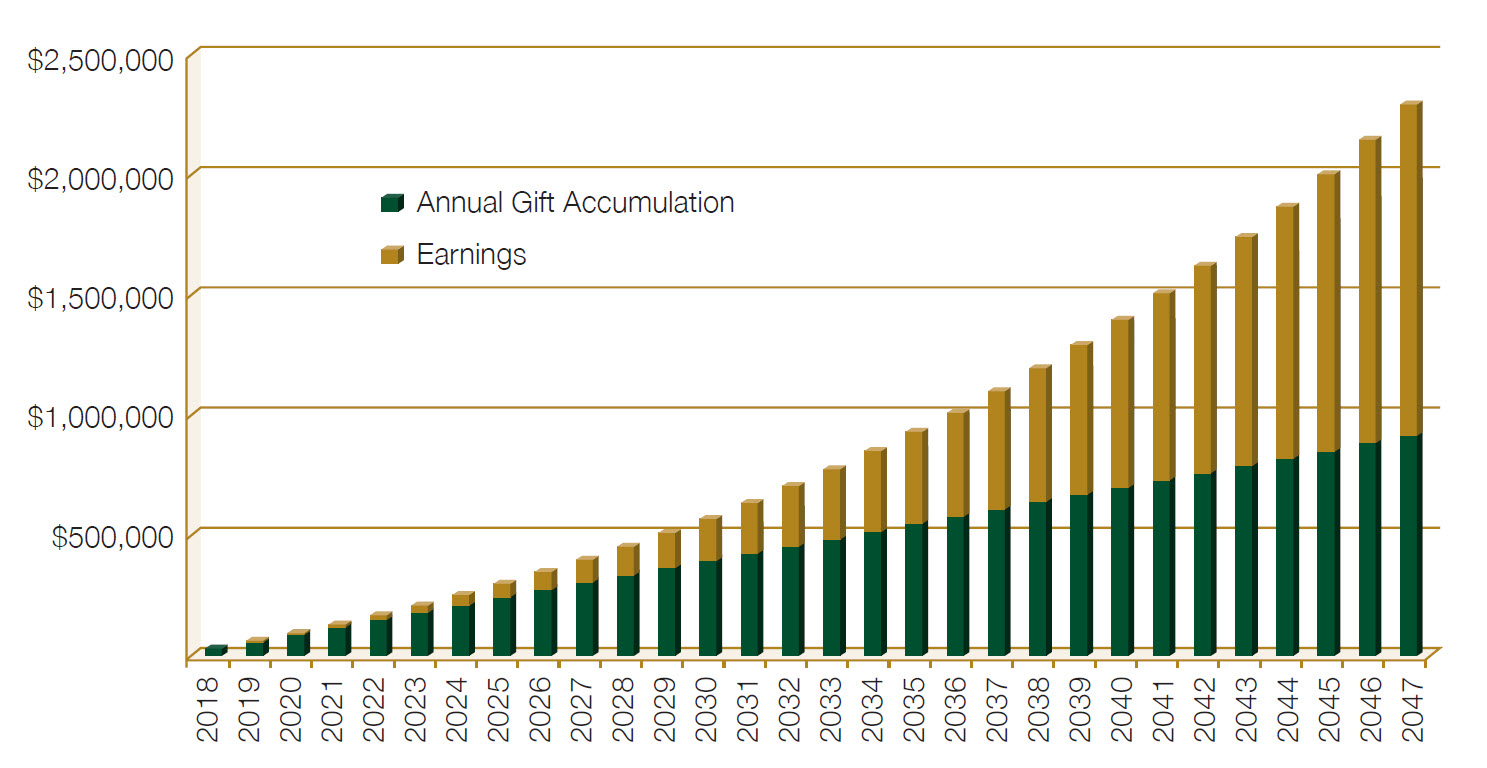

In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

The irs adjusts the threshold each year to account for inflation.

Annual Gift Tax Exclusion 2025 Chart Printable. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation. The irs adjusts the threshold each year to account for inflation.

The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2025, in tandem with the significant adjustments in the. Annual federal gift tax exclusion.

What Is The 2025 Gift Tax Exclusion Aila Lorena, This means that you can give up to $13.61 million in gifts in your. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Married couples filing jointly can take advantage of. For the year 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

2025 Annual Gift and Estate Tax Exemption Adjustments — Southpoint, The annual gift tax exclusion level will increase from $17,000 per person in 2023 to $18,000 per person in 2025, in tandem with the significant adjustments in the. Married couples filing jointly can take advantage of.

2025 Lifetime Gift Exclusion Filide Sybila, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023). The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.